What are NFTs?

NFTs have been one of the most prominent subjects of news coverage over the last year. NFTs, or non-fungible tokens, are digital assets that represent real-world objects such as art, music, in-game items, videos, and most recently, real estate. NFTs are built on the blockchain, which uses decentralized cryptocurrency to create a ledger of transactions. This ledger assures users that their NFTs, cryptocurrency, and other digital assets are authentic.

So what is a fungible and nonfungible token? In essence, a fungible item (or token) is an item that is able to replace or be replaced by another identical item like a toothbrush or a dollar bill. A non-fungible item is an item that is unique and cannot be replaced by an identical item like an original painting such as the Mona Lisa. Non-fungible tokens are units of data stored on a blockchain that are not interchangeable such as an original work of digital art placed on a blockchain such as Ethereum.

What are NFTs Used For?

NFTs took the media by storm when stories of digital artists selling their work garnered millions in profit. NFTs also made news when auctioned off at legendary auction houses like Christie’s and Sotheby’s. Though digital art was the primary use of NFTs, they have many other use cases. Since they’re built on the blockchain, they can be used to ensure the authenticity of products, verify and transfer real estate documents, store medical records and forms of ID, and protect intellectual property. Some speculate they may even have a place in our voting systems because of the blockchain ledger.

The explosion in popularity arose when artists realized that instead of having to go through third-parties like art galleries or auction houses to display and sell creative expression, they can use NFTs to prove provenance and ownership. This also allowed for more lucrative opportunities for digital artists who can utilize the blockchain ledger to make a percentage of sale profit every time their NFT art sells and changes hands. They can do this because they can track the ownership of their NFT on the blockchain.

Buying, Selling, and Minting NFTs

Like tangible assets, NFTs can be bought, sold, and created. Since, in theory, it’s similar to creating a physical coin, the process of creating an NFT is also called minting. So, just how much does it cost to mint an NFT? These costs vary depending on the use of the NFT and the platform on which you choose to mint it.

Before getting into the platform fees, we need to talk about gas fees. A gas fee is a fee that every user has to pay to perform any function on the Ethereum (ETH) blockchain. They’re used to compensate ETH miners for the energy cost of mining. It also functions as a layer of security to keep the network from being spammed. It protects users from cryptocurrency scams, NFT scams, and NFT hacks. The cost varies throughout the day, and users will often use third-party tracking software to find the cheapest times to mint an NFT or perform a transaction.

What is the Best NFT Marketplace for Minting?

On OpenSea, currently the most popular NFT marketplace, users are required to pay two types of fees before they can start selling. Since the fees are paid using Ethereum (ETH), the costs will vary based on the currency's current value. There is an initial fee to authorize your account to start selling. This is usually between $70 - $300. The second fee, around $10 - $30, gives OpenSea access to the NFTs you make.

The marketplace known as Foundation, a more boutique NFT marketplace, takes 15% of the final sale and the platform Rarible takes 2.5% of every sale. They also have a new feature dubbed “lazy minting,” which lets beginners, artists, and creators mint NFTs for free. You don’t need to spend anything from your crypto wallet to get started.

NFT Scams

There are bound to be some scams with any new marketplace, especially a digital one where billions have flooded in over the past few years. This is why it’s more important than ever to have a secure wallet. NFT security is a growing concern and not without good reason. Some projects have lost investors and collectors millions overnight.

NFT Rug Pull

An NFT rug pull is when an NFT creator stops backing the project. This results in a rapid drop in the asset's value and can lead to near-total loss of investors’ and collectors’ money.

In simple terms, users will create an NFT project and then promote and hype up their project online in order to attract investors and excitement about the project. After securing the investments, the users will then “pull the rug” out from beneath their investors’ feet by taking their investors’ money and abandoning the project completely.

So how do you know if an NFT rug is pulled? The way it usually happens is that creators of a project will post news on social media to drive up the price of their collection. What tends to happen next is a total vanishing of Discord channels, Twitter accounts, and a complete withdrawal from the crypto wallet.

One example of an NFT rug pull was in 2022 when the creators behind “Frosties” made off with about $1.3 million after promising to drop a collection of 8,888 NFTs. Sure enough, on January 10th, after the creators posted tons of updates via Discord and Twitter, their channels disappeared, and the funds were gone.

How to Spot an NFT Rug Pull

While there’s no hard and fast way to spot an NFT rug pull or any other crypto scam, there are a few things users can do to mitigate the risk. Some collections like Bored Ape Yacht Club (BAYC) and Cryptopunks partner with other businesses to legitimize their project. BAYC partnered with Adidas to run their NFT project. While not every project needs to partner up with a significant retail company (most obviously will not), it doesn’t hurt, and it implies that hopefully, the household name has done their homework on the creators and the business plan.

Another way to limit the risk of NFT rug pulls is to follow the creators behind the project. By making sure the creators are transparent and have been reputable within the crypto community for some time, you can reduce your risk of getting scammed. It would be best to see the visibility and community around a project before getting swept up in the social media frenzy around it.

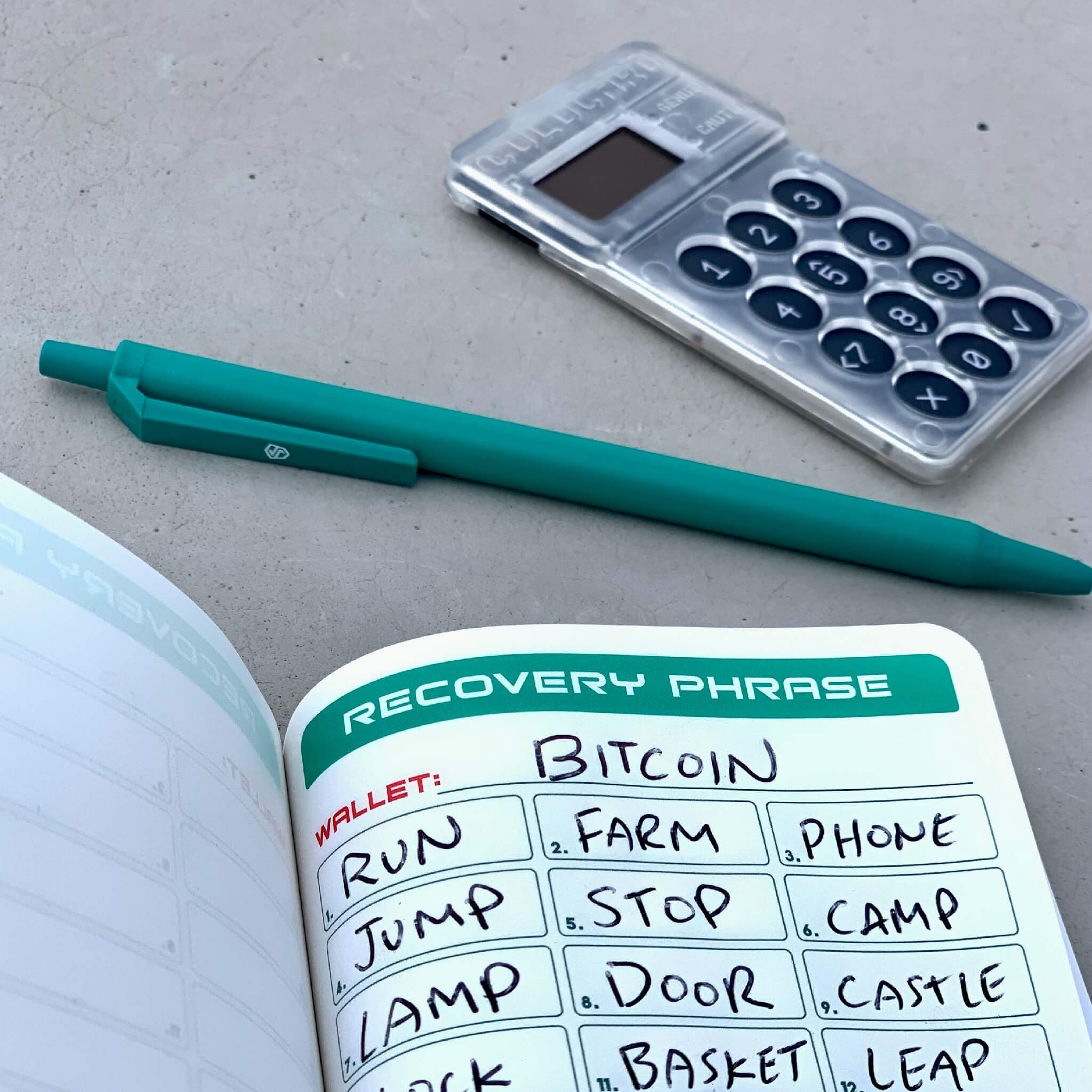

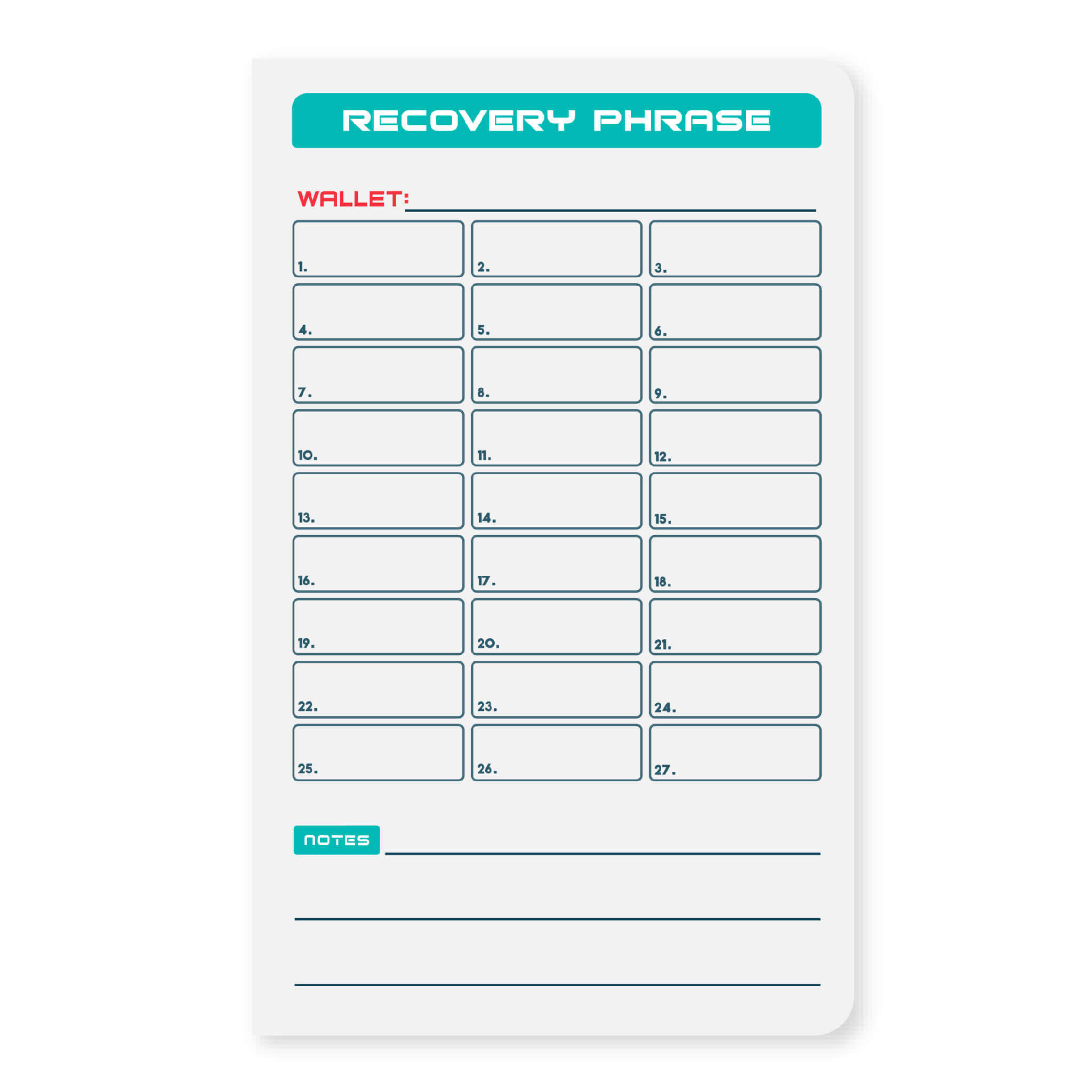

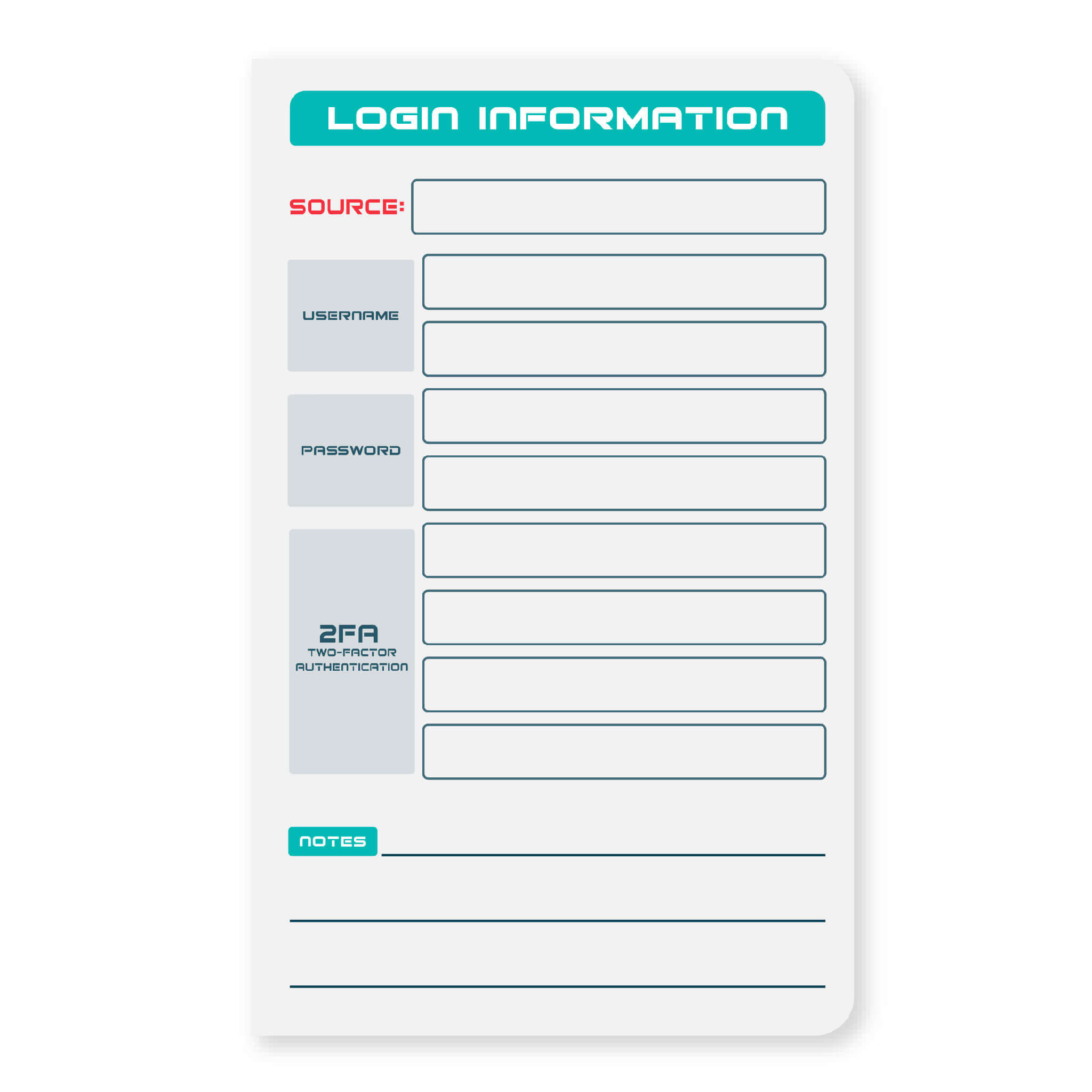

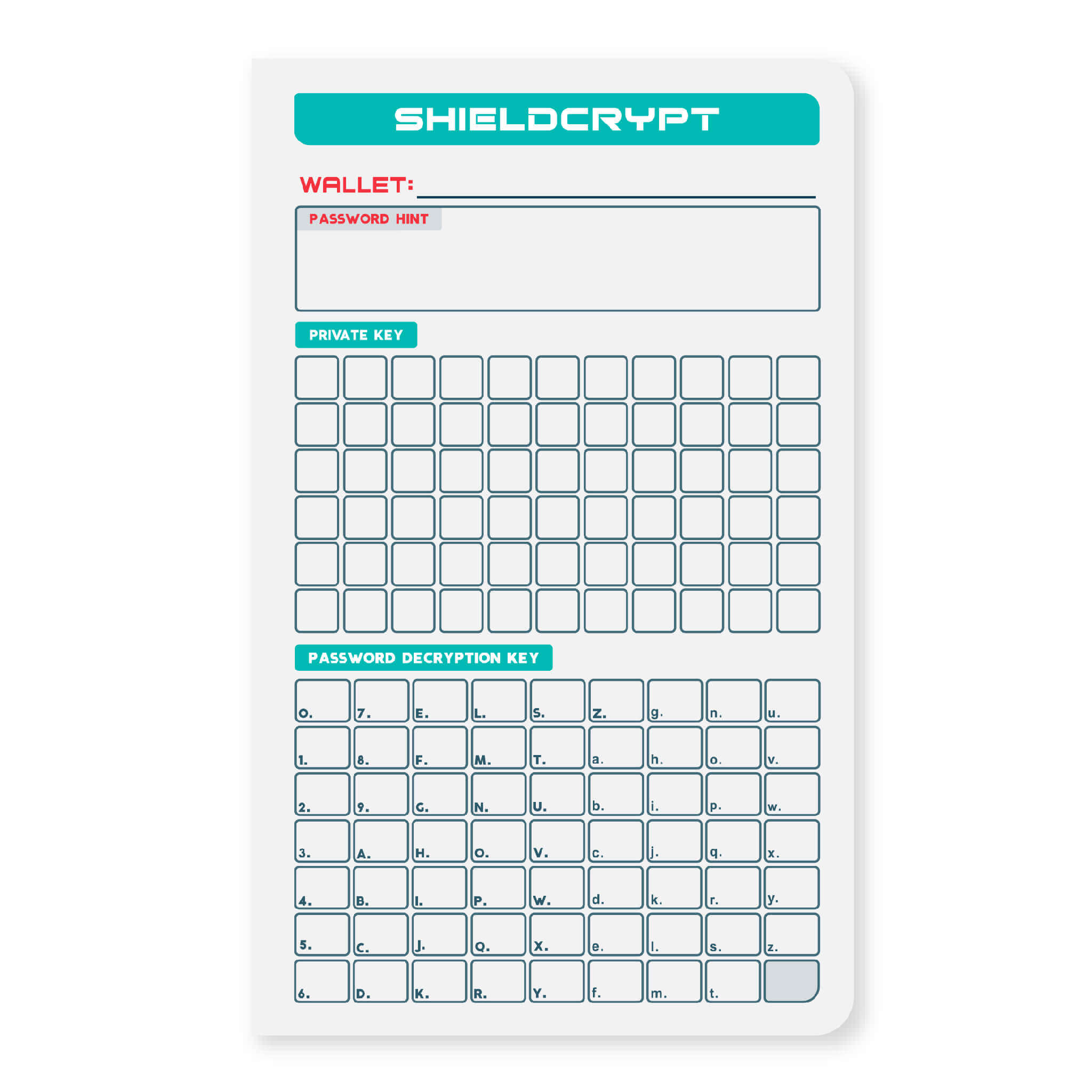

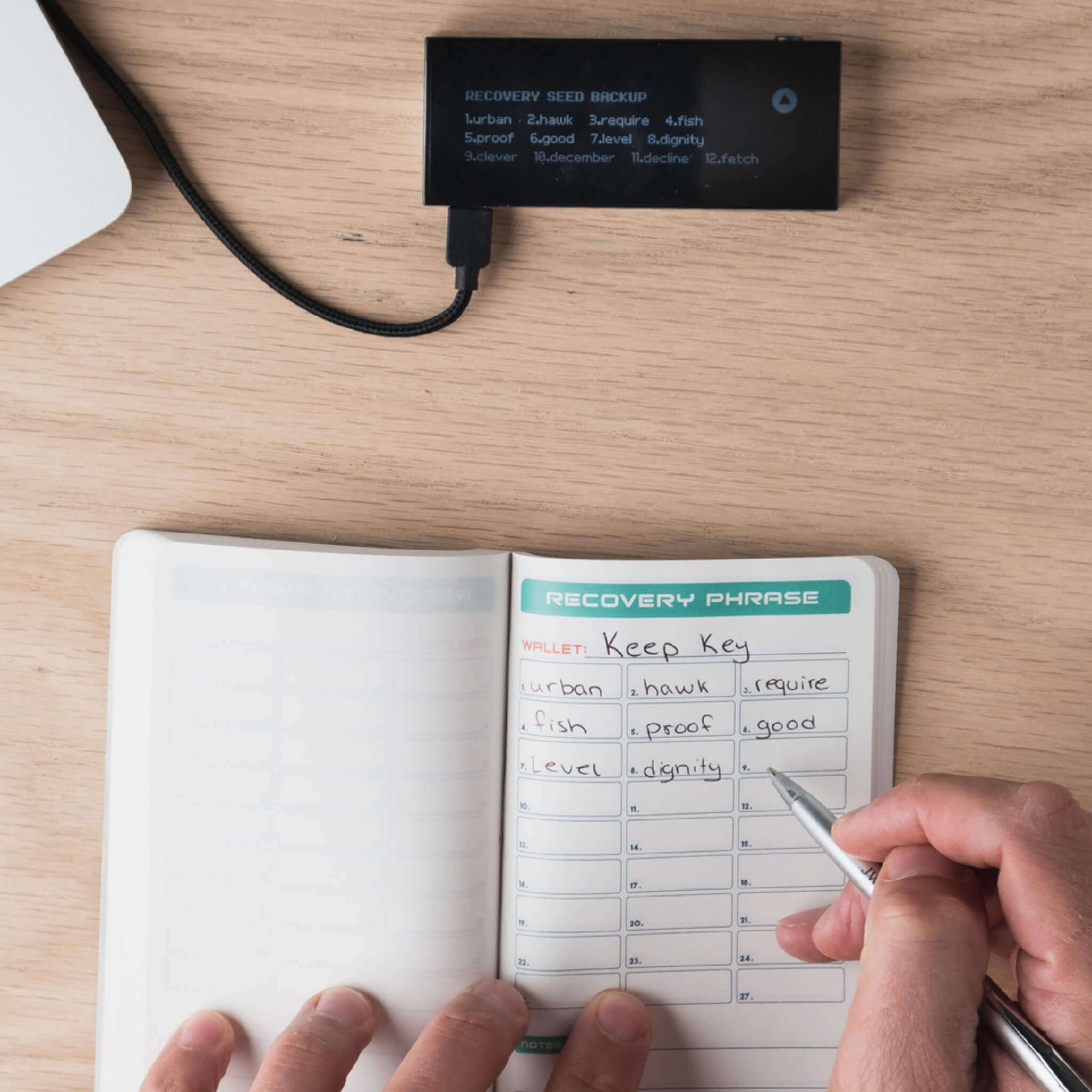

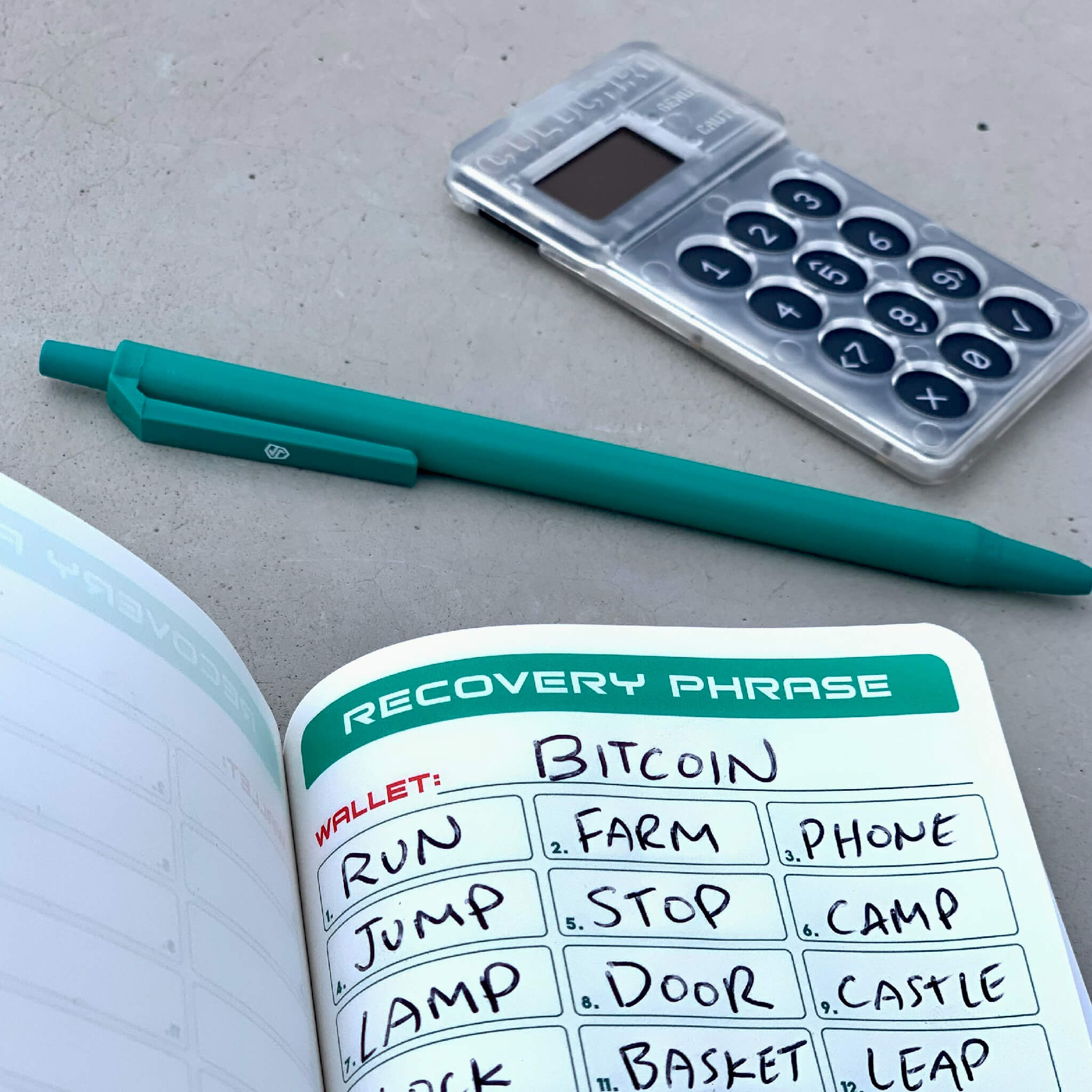

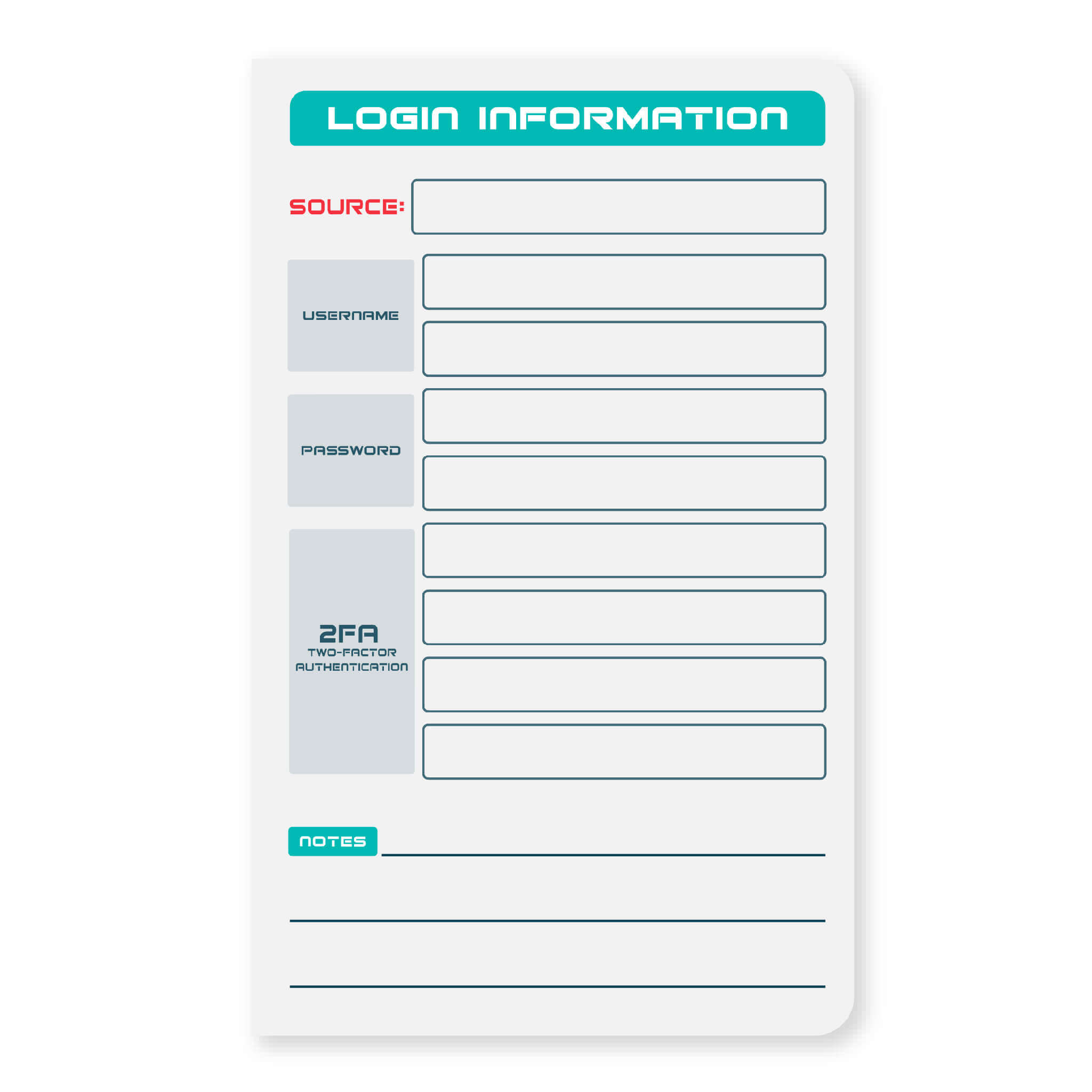

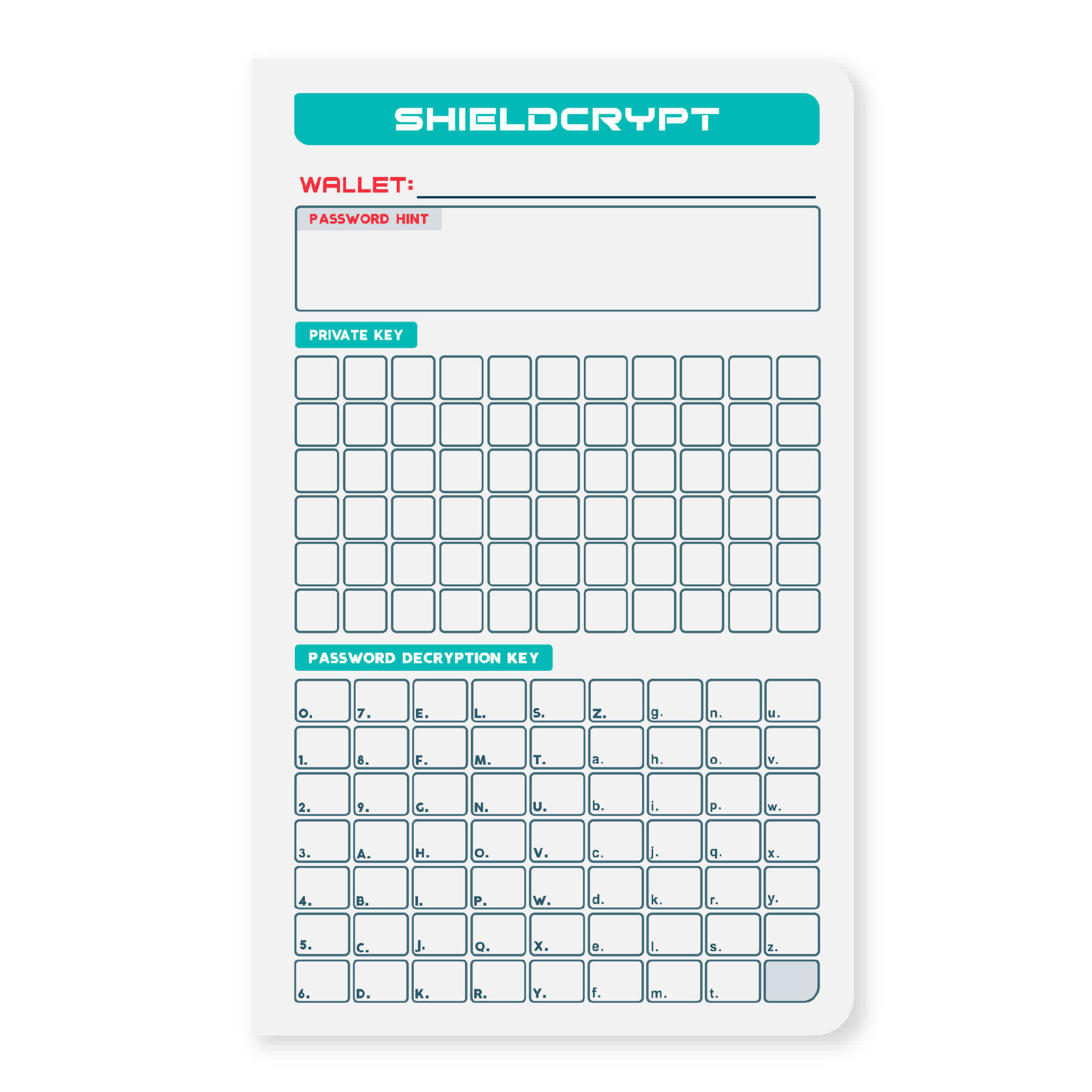

Other than being able to identify a scam online, it is important to be able to protect the seed phrases and private keys associated with a crypto wallet. With the plethora of different wallets, cryptocurrencies, and NFT marketplaces to choose from and the fact that each wallet requires its own set of private keys, it is important to have a safe way of remembering and keeping track of all the private keys.

Keeping your seed phrases stored on anything that has access to the internet means there is no way to 100% guarantee that hackers will not be able to gain access to your private information. The best way to protect your seed phrases and the only way to prevent anyone finding out your seed phrases is to store them somewhere offline that only you will have access to.

Best Wallets for Storing NFTs

Hot Wallets vs. Cold Wallets

When describing NFT wallets, users will break them down into two categories––hot wallets and cold wallets. When buying an NFT, you’ll have the option of storing it in a hot wallet, cold wallet, or a combination of the two.

Hot Wallets

A hot wallet is connected to the internet. This makes it more susceptible to scams, online attacks, and stolen funds. However, it makes it much easier to trade and spend crypto and buy and sell NFTs.

Hot wallets can also be referred to as web-based wallets, desktop wallets, and mobile wallets. Even though both hot and cold wallets are vulnerable to attacks, hot wallets are typically less secure. The ease of use makes them attractive to first-time NFT collectors and crypto users. If you regularly make purchases using crypto or are buying and selling NFTs often, it’s going to be much easier to do with a hot wallet than a cold wallet.

Those with large amounts of crypto generally don’t keep the bulk of their money in a hot wallet. Just like it’s not wise to carry so much cash on your person, for the same reason, it’s foolish to put all of your assets in a hot wallet.

Cold Wallets

A cold wallet is not connected to the internet. While it may be more secure, it comes at the price of convenience and accessibility. Most hardware wallets are also cold wallets. Often they live on a small device that looks like a USB flash drive. After accruing a few hundred dollars in crypto, it's usually wise to invest in a cold wallet. They typically run anywhere from $50 - $200.

Using a Combination

Many collectors, exchanges, and investors store their crypto with a combination of both hot wallets and cold wallets. The solution is simple. Keep some money in your hot wallet for transactions and ease of use while keeping the bulk of your assets in a cold wallet––preventing attacks. You can also transfer crypto from your cold wallet to your hot wallet for bigger transactions and vice versa for when your hot wallet is building up.

Best Wallets

There are a few metrics to judge the efficacy of a crypto wallet by. They include:

- User interface

- Compatibility with your favorite marketplaces

- Security

- Mobile application

- Type of cryptocurrency used/multi-chain support

-

Metamask

Metamask is probably the most popular wallet in the crypto space. It features browser extensions that make connecting to NFT marketplaces easy. There’s also a mobile version that syncs with your desktop wallet instantly.

-

Trust Wallet

Trust Wallet is Binance’s mobile wallet. Binance is the biggest crypto exchange by volume in the world. It also supports multiple blockchains. You can also import your old wallets without installing software or importing crypto keys.

-

Coinbase Wallet

The Best Way to Protect and Store Your Private Keys and Seed Phrases.

The alluring aspects of NFTs mean many crypto users looking to buy and sell these digital assets are looking to safeguard their investments as best they can. Some invest in cold storage wallets to transfer and store their NFTs but often wonder how to keep information like wallet passwords and seed phrases away from prying eyes.

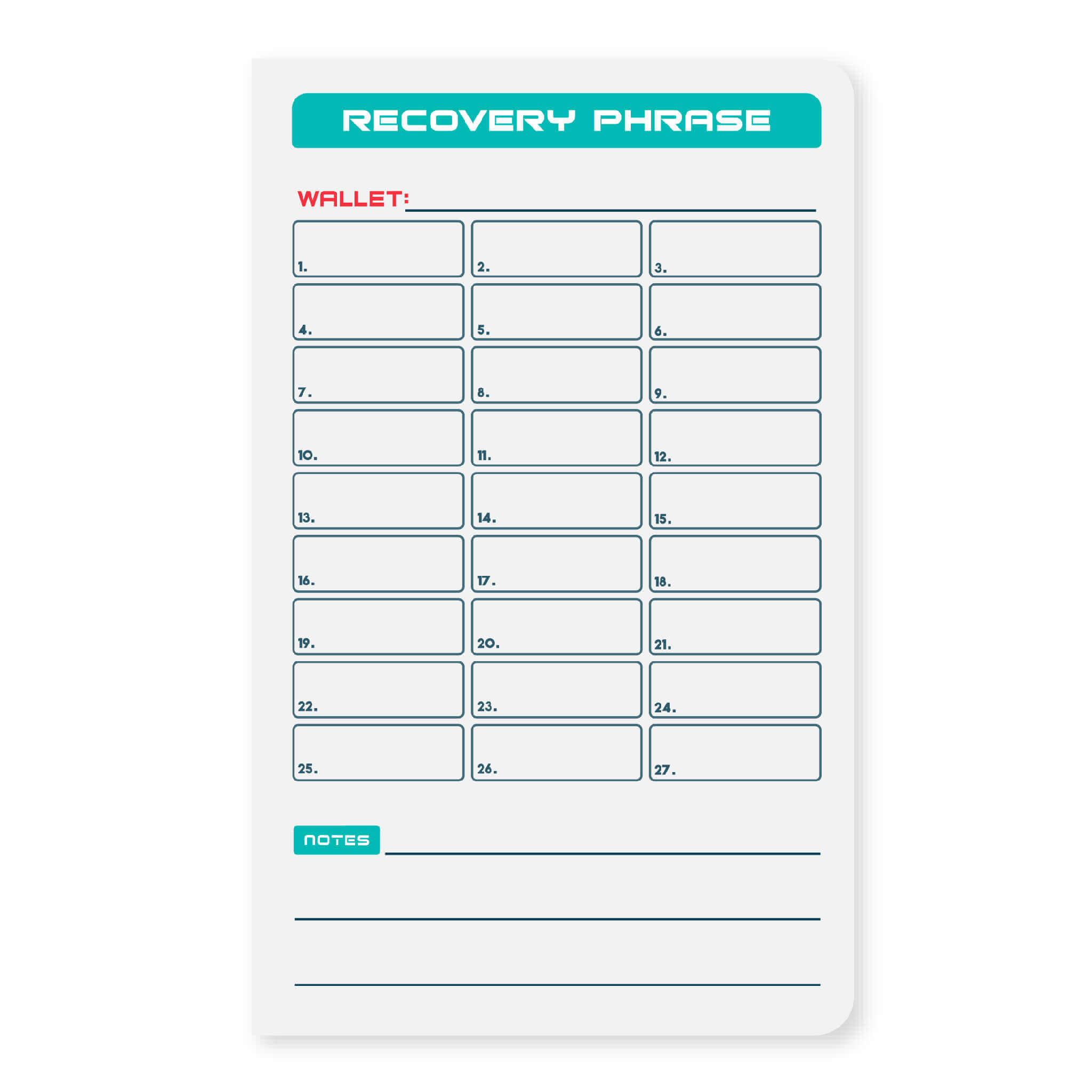

The answer comes in the form of the Shieldfolio Stonebook, a 100% offline water and tear-resistant notebook that makes it easy to write down and safely store private keys, recovery phrases, and passwords. Many often pair the Stonebook with the Ghost Pen, a waterproof invisible ink marker that can only be viewed under a (built-in) UV light.

Unlike other methods of keeping track of private keys and seed phrases that involve heavy, steel blanks punched with different characters to be organized on a steel rod, and placed in a steel capsule, the Stonebook offers the ease of writing out full seed phrases and entire private keys in a lightweight, waterproof, and tear-proof notebook.

Visit Shieldfolio’s website to learn more about the Stonebook and Ghost Pen and buy both items to help keep your NFT purchases safe.

Thumbnail image (MAYC #25458) provided by Stonie.eth, Twitter @Stonekrypt